Ira tax deduction calculator

Ad TIAAs Tools Can Help You Estimate Your IRA Contribution Limit. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or.

Download Roth Ira Calculator Excel Template Exceldatapro

If you have a traditional IRA rather than a Roth IRA you can contribute up to 6000 for 2021 and 2022 and you can deduct it from your taxes.

. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. New Look At Your Financial Strategy. Traditional IRA Tax Deduction Income Limits in 2021 and 2022.

If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600. Save for Retirement by Accessing Fidelitys Range of Investment Options. Ad A Traditional IRA May Be an Excellent Alternative if You Qualify for the Tax Deduction.

If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600. Money deposited in a traditional IRA is treated differently from money in a Roth. If its not you will.

Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. The after-tax cost of contributing to your. The after-tax cost of contributing to your.

Use our IRA calculator to see how much your nest egg will grow by the time you reach retirement. Use AARPs Traditional IRA Calculatorto Know How Much You Can Contribute Annually. Married filing jointly and your spouse is covered by a plan at work.

You can add another 1000 to that. Contributions are made with after-tax dollars. While long-term savings in a Roth IRA may.

Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. The after-tax cost of contributing to your. The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status.

Take Advantage Of Retirement Savings With One Of The Worlds Most Ethical Companies. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600.

Your deduction may be limited if you or your spouse if you are married are covered by a retirement plan at work and your income. While long term savings in a Roth IRA may produce. New Look At Your Financial Strategy.

An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Visit The Official Edward Jones Site. The after-tax cost of contributing to your.

You can adjust that contribution down if you. Many factors can affect your eligibility and contribution limits to either the Traditional IRA or Roth IRA tax filing status your current earned income level and whether or not you participate in a. Not everyone is eligible to contribute this.

Less than 140000 single filer Less than 208000 joint filer Less than. Calculate your earnings and more. Visit The Official Edward Jones Site.

You can contribute to a Roth IRA if your Adjusted Gross Income is. Discover The Answers You Need Here. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. Retirement plan at work. If its a traditional IRA SEP IRA Simple IRA or SARSEP IRA you will owe.

A full deduction 6000 or 7000 if youre at least. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk.

If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600.

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira Calculator Excel Template For Free

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Avoid Paying Double Tax On Ira Contributions Rodgers Associates

Roth Ira Calculator Calculate Tax Free Amount At Retirement

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Tax Calculator Estimate Your Income Tax For 2022 Free

Traditional Ira Calculations Youtube

Payroll Taxes Aren T Being Calculated Using Ira Deduction

Download Roth Ira Calculator Excel Template Exceldatapro

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Ready To Use Traditional Ira Calculator 2021 Msofficegeek

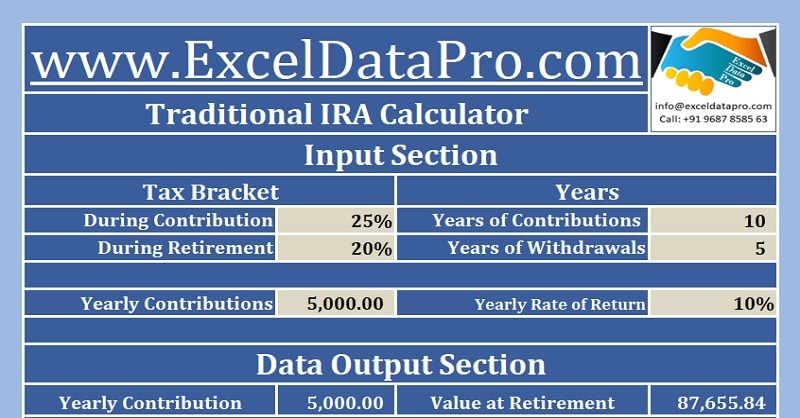

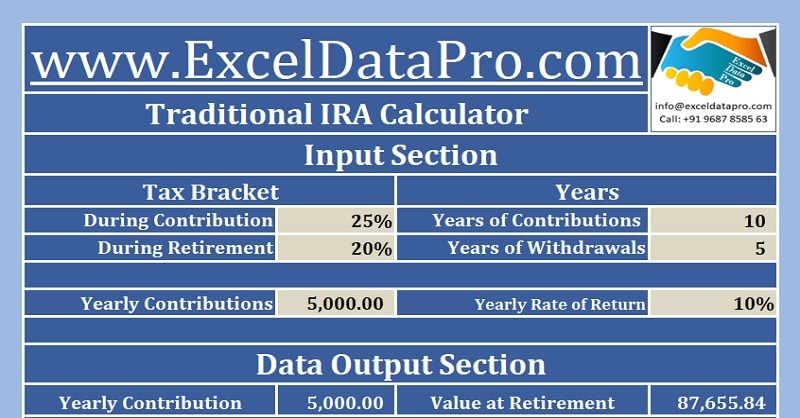

Download Traditional Ira Calculator Excel Template Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal